GENERAL INSURANCE DEFINITION

General insurance covers insurance of property against fire, burglary, theft; personal insurance covering health, travel and accidents; and liability insurance covering legal liabilities. This category of insurance virtually covers all forms of insurance except life. Other covers may include insurance against errors and omissions for professionals, credit insurance etc. Common forms of general insurance are motor, fire, home, marine, health, travel, accident and other miscellaneous forms of non-life insurance.

Unlike life insurance policies, the tenure of general insurance policies is normally not that of a lifetime. The usual term lasts for the duration of a particular economic activity or for a given period of time. Most general insurance products are annual contracts. There are however, a few products which have a long term.

LIST OF GENERAL INSURANCE COMPANIES IN INDIA

Public Sector

Private Sector

Other General Insurance Companies – Specialised

- Agriculture Insurance Co. of India Ltd.

- National Insurance Co. Ltd.

- The New India Assurance Co. Ltd.

- The Oriental Insurance Co. Ltd.

- United India Insurance Co. Ltd.

- Apollo Munich Health Insurance Co. Ltd.

- Bajaj Allianz General Insurance Co. Ltd.

- Bharti AXA General Insurance Co. Ltd.

- Cholamandalam MS General Insurance Co. Ltd.

- CignaTTK Health Insurance Co. Ltd.

- Future Generali India Insurance Co. Ltd.

- HDFC ERGO General Insurance Co. Ltd.

- ICICI Lombard General Insurance Co. Ltd.

- IFFCO-Tokio General Insurance Co. Ltd.

- Kotak Mahindra General Insurance Co. Ltd.

- L&T General Insurance Co. Ltd.

- Liberty Videocon General Insurance Co. Ltd.

- Magma HDI General Insurance Co. Ltd.

- Max Bupa Health Insurance Co. Ltd.

- Raheja QBE General Insurance Co. Ltd.

- Reliance General Insurance Co. Ltd.

- Religare Health Insurance Co. Ltd.

- Royal Sundaram Alliance Insurance Co. Ltd.

- SBI General Insurance Co. Ltd.

- Shriram General Insurance Co. Ltd.

- Star Health and Allied Insurance Co. Ltd.

- Tata AIG General Insurance Co. Ltd.

- Universal Sompo General Insurance Co. Ltd.

- ECGC Ltd. (formerly Export Credit Guarantee Corporation of India Ltd.)

- General Insurance Corporation of India

NON-LIFE INSURANCE INDUSTRY – BUSINESS FIGURES

Gross Direct Premium Income Underwritten for and up to March 2016 (Rs. in crore)

Category of Insurers

March

% Growth (month on month)

Cumulative Figures (up to March)

% Growth (year on year)

2015-16

2014-15

2015-16

2014-15

Private Sector

3928.07

3524.83

11.4%

39701.12

35090.06

13.1%

Public Sector

5101.19

4550.92

12.1%

47717.36

42550.97

12.1%

Stand-alone Health

623.93

488.18

39.2%

4153.77

2942.56

41.2%

Specialised

366.65

543.07

-32.5%

483012

4102.10

17.7%

Grand Total

10019.84

9067.00

10.5%

96402.37

84685.69

13.8%

TYPES OF GENERAL INSURANCE:

MOTOR INSURANCE

Motor insurance covers all damages and liability to a vehicle against various on-road and off-road emergencies. A comprehensive policy even secures against damage caused by natural and man-made calamities, including acts of terrorism.

Motor insurance offers protection to the vehicle owner against:

- Damage to the vehicle

- It also pays for any third party liability determined by law against the owner of the vehicle

Motor insurance is mandatory in India as per the Motor Vehicles Act, 1988 and needs to be renewed every year. Driving a motor vehicle without insurance in a public place is a punishable offence.

In fact, third party insurance is a statutory requirement in our country i.e. the owner of the vehicle is legally liable for any injury or damage caused to a third party life or property, by or arising out of the use of the vehicle in a public place.

A comprehensive motor insurance policy would include personal accident and liability only policy (third party insurance) in addition to own damage cover (damage to owner’s vehicle) in one policy.

Common motor insurance categories include:

- Car Insurance

- Two Wheeler Insurance

- Commercial Vehicle Insurance

Some attractive benefits of motor insurance include roadside assistance, cashless servicing at nation-wide network of workshops and garages, personal accident cover, towing assistance.

HEALTH INSURANCE

Health care costs are increasing every year. Sedentary lifestyle and stress at work negatively affect the health and can result in a critical illness or medical emergency. Such a scenario is sure to adversely affect one financially, due to the massive outlay of money on medical expenditure. A health insurance policy is the only way to mitigate the financial risks, apart from leading a healthy lifestyle. Health insurance guarantees peace of mind in times of crisis, and helps secure own health and that of one’s family.

Health insurance covers the medical and surgical expenses of the insured individual due to hospitalisation from an illness. Additional riders enhance the benefits and scope of the cover.

Health insurance often includes cashless facility at empanelled hospitals, pre and post hospitalisation expenses, ambulance charges, daily cash allowance etc.

Common types of health insurance policies include:

- Individual Policy

- Family Floater Policy

- Surgery Cover

- Comprehensive Health Insurance

TRAVEL INSURANCE

International travel, whether on vacation or business, can turn into a nightmare if one experiences contingencies like loss of baggage, loss of passport, delay in flight, medical emergency etc. Such eventualities will surely take the fun away from travelling.

Travel insurance, also referred to as visitor insurance, covers one against unseen medical and non-medical emergencies during overseas travel, ensuring a worry-free travel experience. It protects the insured against misfortunes while travelling. Backed up by travel insurance, the whole experience is like no other.

Different types of travel insurance policies include:

- Individual Travel Policy

- Family Travel Policy

- Student Travel Insurance

- Senior Citizens Travel Policy

In addition to the above, some insurance companies offer special plans like a corporate travel policy or comprehensive policy for travel to special destinations like Asia and/or Europe.

HOME INSURANCE

Home is often the most treasured possession of an individual and also the largest financial investments one makes in life. Safeguarding the physical structure and contents of home seems like a logical thing to do.

Home insurance protects the house and/or the contents in it, depending on the scope of insurance policy opted for. It secures the home against natural calamities and man-made disasters and threats. Home insurance provides protection against risks and damages from fire, burglary, theft, flood, earthquakes etc. covering the physical asset (building structure) and valuables (contents) in it.

Home insurance ensures that one’s hard-earned savings are utilised to meet important needs instead of using them for rebuilding the house if some harm was to come to it.

MARINE (CARGO) INSURANCE

Business involves the import and export of goods, within national borders and across international borders. Movement of goods is fraught with risk of mishaps which can result in damage and/or destruction of shipments. This leads to substantial financial losses for both the importers as well as the exporters.

Marine cargo insurance covers goods, freight, cargo and other interests against loss or damage during transit by rail, road, sea and/or air. Shipments are protected from the time the goods leave the seller’s warehouse till they reach the buyer’s warehouse. Marine cargo insurance offers complete financial protection during transit of goods and compensates in the event of any loss suffered.

The party responsible for insuring the goods is determined by the sales contract. Marine cargo insurance policy can be taken by buyers, sellers, import/export merchants, buying agents, contractors, banks etc. The policy usually covers the cargo, but can also be extended to cover the interest of a third party post transfer of ownership as determined by terms of sale.

Common types of policies:

- Open Cover

- Open Policy

- Specific Voyage Policy

- Annual Policy

The hull of a ship or boat can be insured under marine hull insurance.

RURAL INSURANCE

Insurance solutions to meet the needs of agriculture and rural businesses form part of rural insurance. IRDA has stipulated annual targets for insurers to provide insurance to the rural and social sector.

As per these regulations, insurers are required to meet year-wise targets:

- In percentage terms of policies underwritten and percentage of total gross premium income by general insurers under rural obligation

- In terms of the number of lives under social obligation

COMMERCIAL INSURANCE

Commercial insurance encompasses solutions for all sectors of the industry arising out of business operations. Insurance solutions for automotive, aviation, construction, chemicals, foods and beverages, manufacturing, oil and gas, pharmaceuticals, power, technology, telecom, textiles, transport and logistics sectors. It covers small and medium scale enterprises, large corporations as well as multinational companies.

Common types of commercial insurance:

- Property Insurance

- Marine Insurance

- Liability Insurance

- Financial Lines Insurance

- Engineering Insurance

- Energy Insurance

- Employee Benefits Insurance

- International Insurance Solutions

OTHER TYPES OF GENERAL INSURANCE:

- Property Insurance

- Personal Accident

- Householder

- Shopkeeper

- Corporate Insurance

- Commercial Insurance

- Fire Insurance

- Crop Insurance

GENERAL INSURANCE COMPANIES IN INDIA – PUBLIC SECTOR:

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED (AIC)

Agriculture Insurance Co. of India was formed on December 20, 2002 on an order of the Government of India, and started its operations from April 1, 2003. The company was been formed to cater to the needs of the agriculture sector and allied activities, and cater especially to the farming community. Agriculture Insurance Co. has 6 promoters including General Insurance Corporation (35%), National Bank for Agriculture And Rural Development (30%), National Insurance Company Limited (8.75%), The New India Assurance Company Limited (8.75%), The Oriental Insurance Company Limited (8.75%) and United India Insurance Company Limited (8.75%).

Its products include:

- National Agricultural Insurance Scheme

- National Crop Insurance Programme (NCIP)

- Bio-Fuel Tree/Plant Insurance

- Varsha Bima (Rainfall Insurance)

- Weather Insurance (RABI)

NATIONAL INSURANCE COMPANY LIMITED (NIC)

National Insurance Company is the country’s oldest general insurance player, having been formed in erstwhile Calcutta on December 5, 1906. It was later nationalised to form National Insurance Company Limited. The company has been a pioneer and has many firsts to its credit, including introduction of insurance product customisation for corporate and rural markets. It is also the first Indian insurance company to have entered into strategic alliances with automobile manufacturers such as Maruti Suzuki and Hero Motors. NIC has also spearheaded bancassurance in the country in partnership with some of the country’s largest banks. The company has been given high credit ratings which demonstrate its strong investment performance in India's insurance market.

Its products include:

Motor Insurance:

- Private Car Insurance Policy

- Motor Cycle Insurance Policy

Health Insurance:

- Overseas Mediclaim Business and Holiday

- Overseas Mediclaim Employment and Studies

- National Parivar Mediclaim

- National Parivar Mediclaim Plus

Personal Insurance:

- Individual Personal Accident

- Janata Personal Accident

- National Hero Accident Suraksha Policy

- Householders Insurance

Rural Insurance:

- Gramin Suswasthya Microinsurance Policy

- Gramin Suraksha Bima Policy

Industrial Risk Insurance:

- Machinery Insurance

- Contractor All Risk

- Electronic Equipment Insurance

Commercial Risk Insurance:

- Marine Insurance - Specific Policy

- Standard Fire and Special Perils

- Shopkeepers Insurance

- Marine Insurance - Marine Cargo Special Declaration Policy

- Credit Insurance

THE NEW INDIA ASSURANCE COMPANY LIMITED

New India Assurance Company was formed as a part of the Tata business empire on July 23, 1919. It was later nationalised in 1973 and is currently one of the largest general insurance players in the country. It was the first general insurance company in India to reach a gross premium of Rs. 16050 crores. The New India Assurance Co. Ltd. has global re-insurance facilities and a significant international presence across 28 countries.

Its products include:

Personal Insurance

Commercial Insurance

Industrial Insurance

Liability Insurance

Social Insurance

- New India Floater Mediclaim Policy

- Householder’s Policy

- Group Mediclaim Policy

- Griha Suvidha Policy

- Shopkeeper’s Policy

- Jewellers Block Policy

- Bankers Indemnity Policy

- Marine Cargo Policy

- Fire Policy

- Burglary Policy

- Machinery Breakdown Policy

- Electronics Equipment Policy

- Public Liability Policy

- Products Liability Policy

- Professional Indemnity Policy

- Directors and Officers Liability Policy

- Universal Health Insurance Scheme for APL families

- Jan Arogya Bima Policy

- Janata Personal Accident Insurance

- Swavlamban

THE ORIENTAL INSURANCE COMPANY LIMITED

The Oriental Insurance Co. specialises in formulating special covers for large industrial projects. The company pioneered laying down systems for smooth conduct of business. All shares of The Oriental Insurance Co. Ltd. are held by the Indian central government. Headquartered in Delhi, it has 31 regional offices and employs over 14,000 people.

Its products include:

Motor Policies:

- Private Car Package Policy

- Two Wheeler Package Policy

- Commercial Vehicle Package Policy

Health Insurance:

- Individual Mediclaim

- Happy Family Floater

- Overseas Mediclaim

- Group Mediclaim

Personal Accident:

- Bhavishya Arogya

- Nagrik Suraksha Policy

- Gramin Accident Insurance

- Janata Personal Accident Policy

Professionals:

- Banker’s Indemnity Insurance Policy

- Directors and Officers Liability Policy

- Sports Insurance Policy

- Stock Brokers Indemnity Insurance Policy

Business Office/Traders/Multi Perils:

- Burglary Policy

- Electronic Equipment Insurance Policy

- Third Party (Lift) Insurance Policy

- Travel Agent Policy (Guarantee)

Engineering/Industry:

- Engineering Insurance

- Boiler Explosion Insurance

- Product Liability Policy

- Standard Fire and Special Perils Policy (Material Damage)

Motor Vehicle - Private/Commercial:

- Motor Cycle Policy - Act Liability

- Motor Cycle Package Policy

- Private Car Package Policy

- Commercial Vehicle - Goods Carrying Act Liability

Agriculture/Sericulture/Poultry:

- Aquaculture (Shrimp/Prawn) Insurance Policy

- Poultry Insurance

- Honey Bee Insurance Scheme

- Sericulture (Silkworm) Insurance

- Animal Driven Cart/Tanga Insurance

Animals/Birds:

- Cattle Insurance

- Calf/Heifers Rearing Insurance Scheme

- Sheep And Goat Insurance

- Pig Insurance

Aviation:

- Aircraft Spares Insurance Policy

- Aircraft Hull/Liability Insurance Policy

- Aviation Fuelling/Refuelling Liability Insurance Policy

- Aviation Group Loss of Licence Insurance

Marine:

- Marine Insurance - Sailing Vessels

- Marine Hull Policy

- Hull Deductible Insurance Policy

- Marine Insurance Policy (Ocean Voyage)

UNITED INDIA INSURANCE COMPANY LIMITED

United India Insurance Company is one of India’s leading non-life insurance companies and was formed through a merger of more than 20 companies during the nationalisation of the insurance sector in 1972. Headquartered in Chennai, the company today boasts of 1340 offices and over 18,000 employees servicing the length and breadth of the country. Its customer base includes everyone from large corporations to the rural agricultural population.

Its products include:

Health Insurance:

- United India Individual Health Insurance Platinum Policy

- United India Individual Health Insurance Gold Policy

- United India Senior Citizens Health Insurance

- United India Insurance Family Medicare Policy

Motor Insurance:

- United India Private Car Package Policy

- United India Two Wheeler Package Policy

Travel Insurance Plan:

- United India Overseas Mediclaim Policy

GENERAL INSURANCE COMPANIES IN INDIA – PRIVATE SECTOR

APOLLO MUNICH HEALTH INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- Apollo Munich Optima Super

- Apollo Munich Optima Senior

- Apollo Munich Maxima

- Apollo Munich Easy Health

Travel Insurance:

- Apollo Munich Easy Travel – Individual

- Easy Travel – Family

- Easy Travel – Senior Citizen

- Easy Travel - Annual Multi Trip Plan

BAJAJ ALLIANZ GENERAL INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- Bajaj Allianz Personal Guard Plan

- Bajaj Allianz Extra Care

- Bajaj Allianz Health EnSure

- Bajaj Allianz Critical Illness

Motor Insurance:

- Bajaj Allianz Car Insurance Policy

- Bajaj Allianz Two Wheeler Insurance

Travel Insurance:

- Bajaj Allianz Corporate Travel Plan

- Bajaj Allianz Student Travel Insurance Plan

- Bajaj Allianz Travel Elite Plan

- Bajaj Allianz Travel Companion Plan

Home Insurance:

- My Home Insurance

- House Holders Package Policy

- Easy House Holders Package Policy

BHARTI AXA GENERAL INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- Bharti AXA SmartHealth Essential Insurance

- Bharti AXA SmartIndividual Personal Accident Insurance Plan

- Bharti AXA SmartHealth Critical Illness

- Bharti AXA SmartHealth Insurance

Motor Insurance:

- Bharti AXA Car Insurance Policy

- Bharti AXA Two Wheeler Insurance

Home Insurance:

- Bharti AXA SmartPlan Householder's Package Policy

Travel Insurance:

- Bharti AXA SmartTraveller Student Travel Insurance Plan

- Bharti AXA SmartTraveller Travel Insurance Plan

CHOLAMANDALAM MS GENERAL INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- Chola MS Individual Health Insurance

- Chola MS Family Health Insurance

- Chola MS Individual Healthline Plan

Car Insurance:

- Chola Protect Car Insurance

Travel Insurance:

- Chola MS Student Travel Protection Plan

- Chola MS Overseas Travel Protection Policy

Home Insurance:

- Chola MS Home Insurance Policy

CIGNATTK HEALTH INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- Cigna TTK ProHealth Cash

- Cigna TTK Lifestyle Protection Accident Care Plan

- Cigna TTK ProHealth Insurance Plan

- Cigna TTK Lifestyle Protection–Critical Care Plan

FUTURE GENERALI INDIA INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- Future Hospicash

- Future Criticare

- Future Health Suraksha - Family Floater

- Future Health Suraksha - Individual

Motor Insurance:

- Future Generali Private Car Insurance

- Future Generali Two Wheeler Insurance

Home Insurance:

- Future Generali Home Suraksha

Travel Insurance:

- Future Travel Suraksha

- Future Student Suraksha

- Future Travel Suraksha - Schengen Travel

HDFC ERGO GENERAL INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- HDFC ERGO Health Suraksha

- HDFC ERGO Health Suraksha Gold Regain

- HDFC ERGO Health Suraksha Top up plus

- HDFC ERGO Critical Illness

Motor Insurance:

- HDFC ERGO Private Car Insurance

- HDFC ERGO Two Wheeler Insurance

- HDFC ERGO Commercial Vehicle Insurance

Home Insurance:

- HDFC ERGO Home Insurance

- HDFC ERGO Standard Fire and Special Perils Insurance

Travel Insurance:

- HDFC ERGO Travel Insurance Plan

- HDFC ERGO Student Suraksha Travel Insurance Plan

Commercial Insurance:

- HDFC ERGO Specialty Insurance

- HDFC ERGO Property & Misc Insurance

- HDFC ERGO Casualty Insurance

- HDFC ERGO Group Insurance

Rural Insurance:

- HDFC ERGO Agriculture Insurance

- HDFC ERGO Cattle Insurance

ICICI LOMBARD GENERAL INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- ICICI Lombard Health Care Plus Insurance Plan

- ICICI Lombard Complete Health Insurance - iHealth Plan

- ICICI Lombard Critical Care

- ICICI Lombard Rishtey Health Insurance

Motor Insurance:

- ICICI Lombard Car Insurance

- ICICI Lombard Two Wheeler & Bike Insurance

Home Insurance:

- ICICI Lombard Home Insurance Policy

Travel Insurance:

- ICICI Lombard International Travel Insurance

- ICICI Lombard Overseas Student Travel Insurance Plan

- ICICI Lombard Senior Citizen Travel Insurance Plan

Business Insurance:

- ICICI Lombard Fire Insurance

- ICICI Lombard Marine Insurance

- ICICI Lombard Industrial Insurance

- ICICI Lombard Corporate Insurance

Rural Insurance:

- ICICI Lombard Tractor Insurance

- ICICI Lombard Weather Insurance

IFFCO-TOKIO GENERAL INSURANCE COMPANY LIMITED

Its products include:

Health Insurance:

- IFFCO Tokio Health Protector Policy

- IFFCO Tokio Individual Medishield Policy

- IFFCO Tokio Swasthya Kavach Family Health

- IFFCO Tokio Critical Illness Insurance

Motor Insurance:

- IFFCO Tokio Car Insurance Policy

- IFFCO Tokio Two wheeler Insurance

Home Insurance:

- IFFCO Tokio Home Suvidha Policy

- IFFCO Tokio Home Family Protector Policy

Travel Insurance:

- IFFCO Tokio Travel Protector

Other Insurance:

- Trade Protector Policy

- Trade Suvidha Policy

Kotak Mahindra General Insurance Company Limited

Its products include:

Health Insurance:

- Kotak Health Care - Excel

- Kotak Health Care - Premium

Motor Insurance:

- Kotak Car Secure

- Goods Carrying Vehicle

- Miscellaneous Vehicle

L&T General Insurance Company Limited

Its products include:

Health Insurance:

- L&T my:health Medisure Plus Insurance

- L&T my:health Medisure Super Top Up Insurance

- L&T my:health Medisure Classic Insurance

- L&T my:health Medisure Prime Insurance

Motor Insurance:

- L&T my:asset Private Car Package Policy

- L&T my:asset Private Car Liability Policy

- L&T my:asset Two Wheeler Liability Policy

Home Insurance:

- L&T my:asset Premium Home Insurance

- L&T my:asset Primary Home Insurance

- L&T my:asset Insta Home Insurance

- L&T my:asset Super Home Insurance

Corporate:

- Standard Fire & Special Perils Insurance

- Machinery Breakdown Insurance

- Electronic Equipment Insurance

- Erection All Risks Insurance

SME Insurance:

- L&T my:business Commercial Establishment Insurance

- L&T my:business Hospitality and Leisure Insurance

- L&T my:business Retail Establishment Insurance

- L&T my:business Educational Institution Insurance

Max Bupa Health Insurance Company Limited

Its products include:

Health Insurance:

- Max Bupa Health Assurance Plan

- Max Bupa Heartbeat - Family Floater

- Max Bupa Heartbeat - Family First

- Max Bupa Heartbeat - Individual

Reliance General Insurance Company Limited

Its products include:

Health Insurance:

- Reliance HealthGain Policy

- Reliance Critical Illness Policy

- Reliance HealthWise Policy

Motor Insurance:

- Reliance Private Car Insurance

- Reliance Two Wheeler Insurance

Home Insurance:

- Reliance Householder's Package Policy

Travel Insurance:

- Reliance Travel Care Policy

- Reliance Student Travel Insurance

- Reliance Annual Multi-trip Travel Insurance Plan

- Reliance Senior Citizens Travel Insurance

Corporate Insurance:

- Fire Insurance

- Engineering Insurance

- Marine Insurance

- Liability Insurance

SME Insurance:

- Burglary & Housebreaking

- Fire Insurance

- Package Insurance

- Group Mediclaim Insurance

Religare Health Insurance Company Limited

Its products include:

Health Insurance:

- Religare Care

- Religare Care Freedom

- Religare Joy

- Religare Enhance

Travel Insurance:

- Religare Explore

- Religare Student Explore

Fixed Benefit Insurance:

- Religare Assure

- Religare Secure

Royal Sundaram Alliance Insurance Company Limited

Its products include:

Health Insurance:

- Royal Sundaram Family Good Health Insurance Plan

- Royal Sundaram Lifeline Health Insurance Plan

- Royal Sundaram Family Health Insurance

- Royal Sundaram Health Shield

Motor Insurance:

- Royal Sundaram Car Shield

- Royal Sundaram Two Wheeler Package Insurance

- Royal Sundaram Commercial Vehicle Insurance

Home Insurance:

- Royal Sundaram Home Content

- Royal Sundaram Home Shield

Travel Insurance:

- Royal Sundaram Overseas Travel Insurance Plan

Business Solutions:

- Marine Insurance

- Engineering Insurance

- Industrial All Risks

- Office Shield

Employee Solutions:

- Farmers Insurance

- Livestock Insurance

- Pumps Insurance

- Rural Micro Enterprise Shield

Social Sector:

- Royal Sundaram Shakthi Health Shield

- Royal Sundaram Shakthi Security Shield

SBI General Insurance Company Limited

Its products include:

Health Insurance:

- SBI General's Hospital Daily Cash Insurance Policy

- SBI General's Critical Illness Insurance Policy

- SBI General's Health Insurance Policy - Retail

- SBI General's Arogya Premier Policy

Motor Insurance:

- SBI General's Private Car Insurance Policy - Package

- SBI General's Two Wheeler Package Policy

Home Insurance:

- SBI General's Long Term Home Insurance Policy

Travel Insurance:

- SBI General's Travel Insurance Policy

Liberty Videocon General Insurance Co. Ltd.

Its products include:

Personal Insurance

- Health Insurance

- Private Car Insurance

- Two Wheeler Insurance

Corporate Solutions

- Engineering

- Property

- Employee Benefit

- Liabilities Insurance

- Fleet Insurance

Magma HDI General Insurance Co. Ltd.

Its products include:

Motor Insurance:

- Private Car Insurance Package

- Two Wheeler Insurance Package

- Commercial Comprehensive Insurance Package

- Tractor Package

- Motor Act Only Policy

- Motor Trade Insurance Package

- Motor Trade Internal Risk Insurance

Liability Insurance:

- Public Liability Insurance Act

- Public Liability Non - Industrial Insurance

- Public Liability Industrial Insurance

- Product Liability Insurance

- Errors And Omissions Insurance Policy

- Directors & Officers Liability Policy

- Clinical Trials Liability Policy

Fire Insurance:

- Standard Fire and Special Perils Insurance Policy

- Fire Loss of Profits Insurance Policy

- Industrial All Risk Insurance

Engineering Insurance:

- Machinery Breakdown Insurance

- Boiler & Pressure Plant Insurance

- Machinery Loss Of Profits Insurance Policy

- Electronic Equipment Insurance

- Contractor's Plant And Machinery Insurance

- Erection All Risk Insurance

- Contractor's All Risks Insurance

Raheja QBE General Insurance Co. Ltd.

Its products include:

Personal:

- Accident Personal Cover

- Cattle Insurance

- Domestic Property Policy

- Health Insurance

Corporate:

- Accident Corporate

- Commercial Packages

- Commercial Property

- Construction & Engineering

- General Liability

- Marine

- Motor

- Professional Liability

- Workers Compensation

- Miscellaneous

Shriram General Insurance Co. Ltd.

Its products include:

Motor Insurance:

- Car insurance

- 2 Wheeler Insurance

- Commercial Vehicle Insurance

Fire insurance:

- Standard Fire & Special Perils Policy

- Industrial All Risk Policy

- Fire Loss of Profit Policy

Engineering Insurance:

- Contractors All Risk Insurance Policy

- Erection All Risk Insurance Policy

- Electronic Equipment Insurance Policy

- Machinery Breakdown Insurance Policy

- Contractor’s Plant and Machinery Insurance

- Boiler & Pressure Plant Insurance Policy

Marine Insurance:

- Cargo Insurance Policy

Liability Insurance:

- Professional Indemnity - For Doctors and Other Than Doctors

- Commercial General Liability

- Error & Omissions - For Medical Establishments

- Product Liability

- Public Liability - Non Industrial

- Public Liability - Act

- Workman Compensation Insurance

Star Health and Allied Insurance Co. Ltd.

Its products include:

Health:

- Family Health Optima Insurance Plan

- Star Comprehensive Insurance Policy

- Senior Citizens Red Carpet Health Insurance Policy

- Medi-Classic Insurance Policy (Individual)

Travel:

- Star Travel Protect Insurance Policy

- Star Corporate Travel Protect Insurance Policy

- Star Student Travel Protect Insurance Policy

- Star Family Travel Protect Insurance Policy

Personal Accident:

- Accident Care Individual Insurance Policy

- Student Care

- Janatha Personal Accident Group

Tata AIG General Insurance Co. Ltd.

Its products include:

Motor:

- Auto Secure-Private Car Package Policy

- Auto Secure-Two Wheeler Package Policy

- Auto Secure-Commercial Vehicle Package Policy

Travel:

- Travel Guard

- Student Guard- Overseas Health Insurance Plan

- Asia Travel Guard Policy

- Domestic Travel Guard Policy

Health:

- MediPrime

- Wellsurance Executive Policy

- Wellsurance Family Policy

- Wellsurance Woman Policy

- Critical Illness

- Individual Accident and Sickness Hospital Cash Policy

- MediPlus

- MediSenior

- MediRaksha

- Group Accident and Sickness Hospital Cash Policy

Personal Accident:

- Accident Guard Policy

- Injury Guard Policy

- Income Guard Plan

- Secured Future Plan

- Secured Income High Policy

- Maha Raksha Personal Injury Policy

Home:

- Instachoice Home Insurance

- Home Secure Supreme

- Home Coupon

- Standard Fire and Special Perils

Business:

- Small Business Insurance

- Corporate Insurance

- Rural Insurance

Universal Sompo General Insurance Co. Ltd.

Its products include:

Motor

- Private Car Insurance

- Two Wheeler Insurance Policy

Health

- Complete Health Care Insurance

- Senior Citizen Health Insurance Policy

- Saral Suraksha Bima

- Sampoorna Swasthya Kavach

- Aapat Suraksha Bima Policy

Travel

- Overseas Travel Insurance

Personal Accident

- Individual Personal Accident Policy

Home

Householder's Insurance Policy

CLAIM PROCESS FOR GENERAL INSURANCE

Every insurance company presents its best facet while selling a plan but it is the Claim Settlement that really decides how good the company really is. As a buyer you should ideally look for 3 factors while making a purchase –

- Claim settlement ratio – The number of claims settled by the company to the total number of claims filed in a financial year.

- Incurred claim ratio – The total amount spent on claims to the total amount earned as a premium by the insurance company in a financial year.

- Claim settlement turnaround time – It signifies the time span between the filing of a claim and settling of a claim. In other words, it is the time taken by the insurance company to settle a claim.

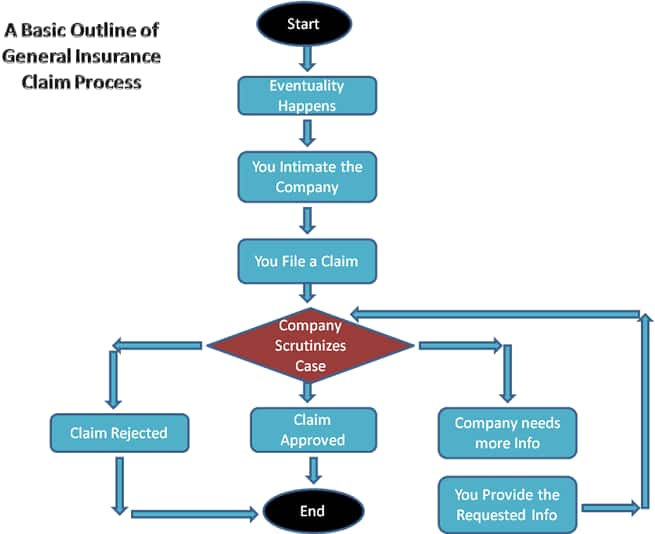

The basic outline of a claim process for the general insurance is -

TAX BENEFITS VIA GENERAL INSURANCE

Of all the forms of general insurance, only Health Insurance comes with tax benefits. As per Section 80D of the income tax act 1961, the premium paid for a health insurance plan qualifies for tax deduction from your total income. The upper limit for this deductible amount is Rs 15,000 and is extendible up to Rs 20,000 for senior citizens. So, if you pay the premium both for yourself and your parents, a maximum of Rs 35,000 will qualify for tax deduction from your total income.